how to beat the windfall elimination provision

Employment for which you didnt pay Social Security taxes is to accrue 30 or more years of substantial earnings under Social Security. But those previous attempts have failed.

The Best Explanation Of The Windfall Elimination Provision 2021 Update Social Security Intelligence

But it will affect you if you work.

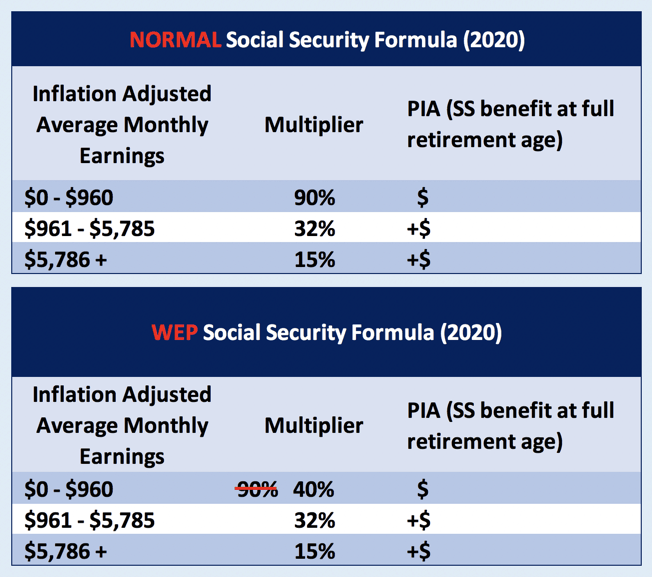

. An Example of the PSP Formula in Action. The answer explains when. The Windfall Elimination Provision. Under the provision we reduce the 90 percent factor in our formula and phase it in for workers who reached age 62 or became disabled between 1986 and 1989.

First off please understand if you hav. The Windfall Elimination Provision WEP is a formula that can reduce the size of your Social Security retirement or disability benefit if you receive a pension from a job in which you did not pay Social Security taxesSuch a non-covered pension might have been earned for instance by work for a state or local government agency that does not participate in FICA payroll-tax withholding. The only way to avoid the Windfall Elimination Provision WEP when you are receiving a pension from non-covered employment ie. The WEP which took effect in 1983 provides a means of eliminating the windfall of Social Security benefits received by beneficiaries who also receive a pension based on work not covered.

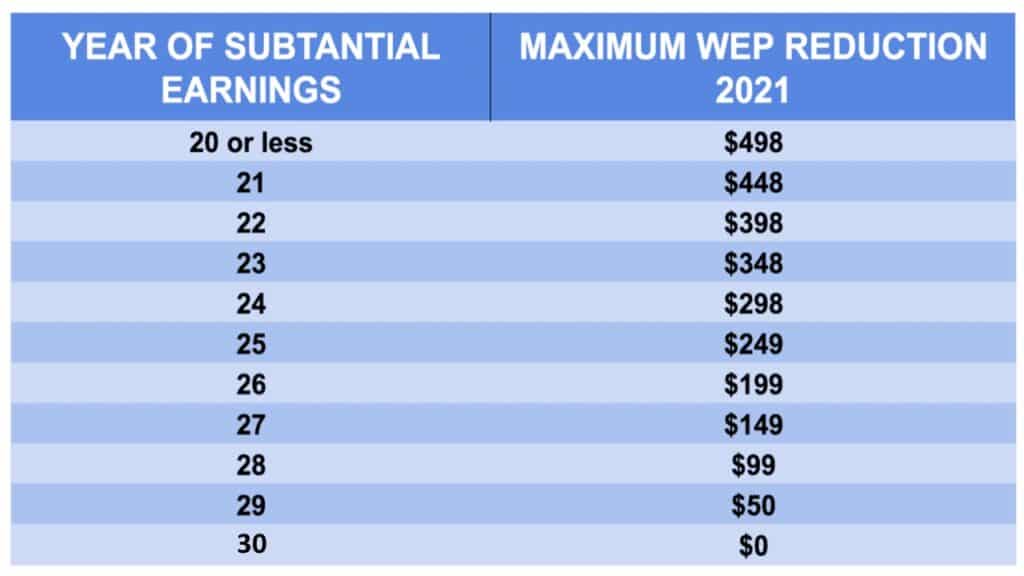

Nov 09 2021 In December 2020 about 19 million people or about 3 of all Social WEPs supporters argue that the formula is a reasonable means to prevent The legislation would repeal the WEP and the government pension. If you receive a Federal pension and are also eligible for Social Security benefits based on your own employment record a different formula may be used to compute your Social Security benefit. If you have 30 years of paychecks with FICA taxes withheld this wont affect you. The more years in which you met the substantial earnings test the less the Windfall Elimination Provision takes out of your Social Security payments.

This formula will result in a lower benefit. Windfall Elimination Provision WEP If you accrued 40 quarters 10 years of employment where social security payments were withheld you are eligible for benefits. The legislation reflects ongoing conversations with. These Frequently Asked Questions FAQs provide general guidance about the Windfall Elimination Provision WEP.

Your Primary Insurance Amount PIA which is simply your Social Security payment will be impacted. The Windfall Elimination Provision WEP can significantly reduce your Social. Todays question asks if its possible to avoid triggering the Windfall Elimination Provision WEP that affects some government employees by moving to another state. The Windfall Elimination Provision affects workers who reach age 62 or.

The Windfall Elimination Provision WEP is simply a recalculation of your Social Security benefit if you also have a pension from non-covered work no Social Security taxes paid. While there arent many the Windfall Elimination Provision WEP can affect your Social Security benefit. How Social Securitys Windfall Elimination Provision Affects Some Federal Retirees Our teachers police and firefighters shouldnt have their Social Security checks docked each month simply due to an outdated unfair formula from the 1980s Brady said. 2 days agoA decades-old provision that limits the Social Security benefits of nearly 2 million public-sector retirees and workers could be headed to the chopping block.

This year there are two bills worth keeping an eye on. I get a lot of questions about the Windfall Elimination Provision WEP what is it and how it may affect retirees. Kevin Brady R-Texas aims to nix the windfall elimination provision WEP and replace it with a new formula for calculating the Social Security benefits of certain government employees with. And when planning for retirement its important to know exactly how much of a benefit you are eligible to receive.

To use the WEP calculator plug in your date of birth the age at which you claimed or plan to claim Social Security your monthly. Multiply PIA by the ratio of AIME with all covered and non-covered earnings to AIME with covered earnings only. Separate FAQs for the GPO are available here. Calculate the PIA using both covered and non-covered earnings with the normal non-WEP formula using 90 as the first multiplier.

In 1983 Congress passed the Windfall Elimination Provision WEP. They do not cover the Government Pension Offset GPO. Abigail Spanberger D-Va and Rodney Davis R-Ill introduced earlier this year. For people who reach 62 or became disabled in 1990 or later we reduce the 90 percent factor to as little as 40 percent.

The normal Social Security calculation formula is substituted with a new calculation that results in. Come October 2019 I reach 66 years of age wanted to start claiming Soc Sec benefits and my UK State pension roughly 500 per month but while on the US Soc Sec site came across the WEP windfall exclusion provision which basically states if you collect Pension elsewhere in my case UK my soc sec benefits can be reduced up to 467 per month. Various members of Congress have made multiple attempts to eliminate the WEP and GPO or at least reduce its impact over the course of the last decade. The FAQs assume you are or were a state or local government employee who works or worked in employment not covered by Social Security.

This legislation put a stop to workers collecting full Social Security retirement or disability benefits and a full pension from their job even though during that job they were not paying Social Security taxes. Windfall elimination provision WEP is designed to remove such an unintended advantage or windfall for certain beneficiaries with earnings not covered by Social Security. If you have 30 or more such years the WEP does not apply theres no benefit reduction based on your pension. Formulas The Current WEP Formula The regular Social Security benefit formula applies three factors90 32 and 15to three different brackets of a workers AIME.

This legislation finally gets rid of Social Securitys Windfall Elimination Provision WEP and replaces it with a new formula that makes sure that teachers firefighters police officers and other public servants receive a Social Security benefit that is based on their actual work history. One is the Social Security Fairness Act which Reps. The Windfall Elimination Provision Explained. 34 rows How To Use The WEP Chart.

The Windfall Elimination Provision WEP is an unfair federal provision preventing retirees from receiving the Social Security benefits they are owed. Passed the Windfall Elimination Provision to remove that advantage. Legislation recently introduced by US. Go to the ELY column to find the year you reach age 62 or.

What Is The Windfall Provision For Social Security

The Best Explanation Of The Windfall Elimination Provision 2021 Update Social Security Intelligence

Unnecessary Legislation The Wep Should Not Be Repealed

Liz Weston Confused About Social Security S Windfall Elimination Provision Here S An Explanation Oregonlive Com

The Best Explanation Of The Windfall Elimination Provision 2021 Update Social Security Intelligence

The Best Explanation Of The Windfall Elimination Provision 2021 Update Social Security Intelligence

The Best Explanation Of The Windfall Elimination Provision 2021 Update Social Security Intelligence

Legislation Would Reform Social Security S Windfall Elimination Provision

Posting Komentar untuk "how to beat the windfall elimination provision"